Air freight is of great importance to the UK economy, as Steer has demonstrated in the study we undertook for Airlines UK in 2018 (with support from Heathrow Airport Limited, Manchester Airports Group and the Freight Transport Association). During the COVID pandemic, in strong contrast to the performance of passenger air services, air freight has held up relatively well, with a fall of only 32% at London Heathrow airport (normally by far the dominant air freight hub for the country) compared to a 65% reduction in passengers to the end of August (CAA data). At two of the other largest freight-handling airports, East Midlands and Stansted, freight volumes have actually increased.

In 2017 belly-hold cargo at Heathrow accounted for over 60% of total UK air freight volume, with forwarders and shippers utilising its extensive intercontinental passenger network. Over 30% of total air freight was shipped on US routes and most of the remainder on Asian routes. Freighter and integrator cargo was concentrated at East Midlands and Stansted, which together accounted for over 20% of all UK freight and the majority of freighter (60%) and integrator (79%) activity. Integrators accounted for over 90% of freight at East Midlands. At Stansted, integrators FedEx and UPS were the largest cargo airlines, although intercontinental freighters such as Qatar Airways, Cargolux and China Southern also accounted for a large share of volume.

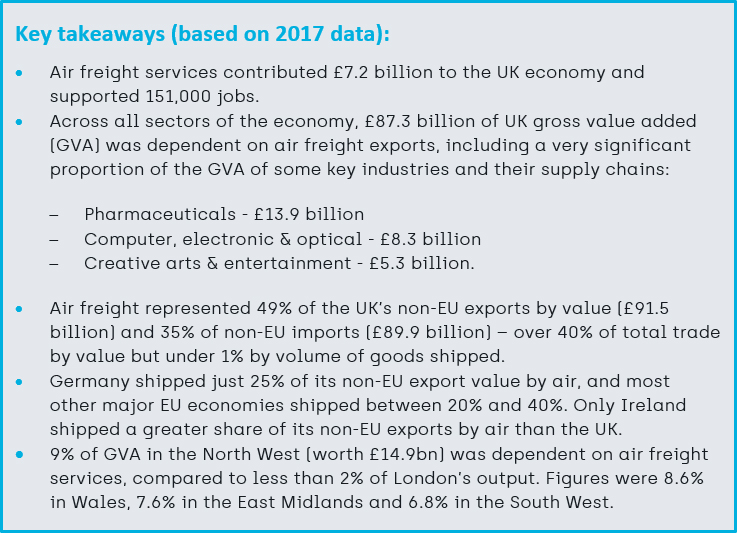

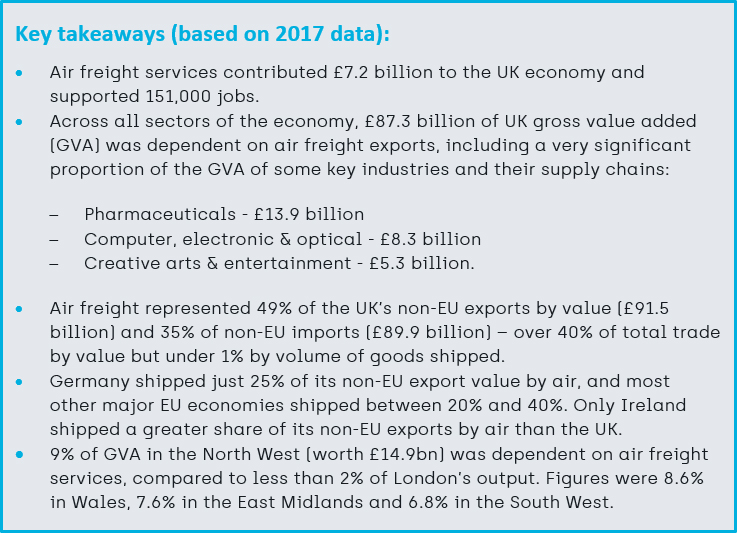

While air freight is relatively small in volume terms, it has high value. In 2017, the UK’s non-EU trade classified as being transported by air accounted for over 40% in terms of value but under 1% of total trade in volume terms (with sea accounting for over 98%). Air freight represented 49% by value of non-EU exports (£91.5 billion) and 35% by value of non-EU imports (£89.9 billion).

Many of the products with a high share of UK trade value transported by air, such as aircraft engine parts and power-generating machinery, have a high share of both import and export value, likely reflecting the global nature of these industries’ supply chains and manufacturing processes. One exception is pharmaceuticals, which account for a significant proportion of export (but not import) value.

In estimating the economic value of air freight, there are two different but complementary perspectives. The first approach is to estimate the traditional measure of economic impacts on employment, income and GVA of the air freight industry and associated services. The second approach is to estimate the wider economic impacts of air freight, sometimes referred to as “catalytic impacts”, which consider how air freight facilitates economic activity in other sectors.

Using the first approach, we estimated that the air freight industry (including indirect and induced impacts) supports GVA of £7.2 billion, 151,000 jobs and associated income of £4.1 billion (2017 data and prices). Using the second approach, we estimated that £87.3 billion of national GVA was based on air freight exports, representing 5% of the total GVA measure of national output (£1,747 billion in 2016).

The air freight study was presented to policymakers in the House of Commons and was well-received across the political spectrum. It represents an excellent example of how Steer’s expertise contributes to discussion and understanding across the industry, based on our independent and fact-based approach.