Recently, my friend Philip Northard released some terrific insight from Cox Automotive on a sharp decline in used electric vehicle (EV) residuals. While this is sure to alarm lease underwriters, it's perhaps not unexpected.

The First Wave

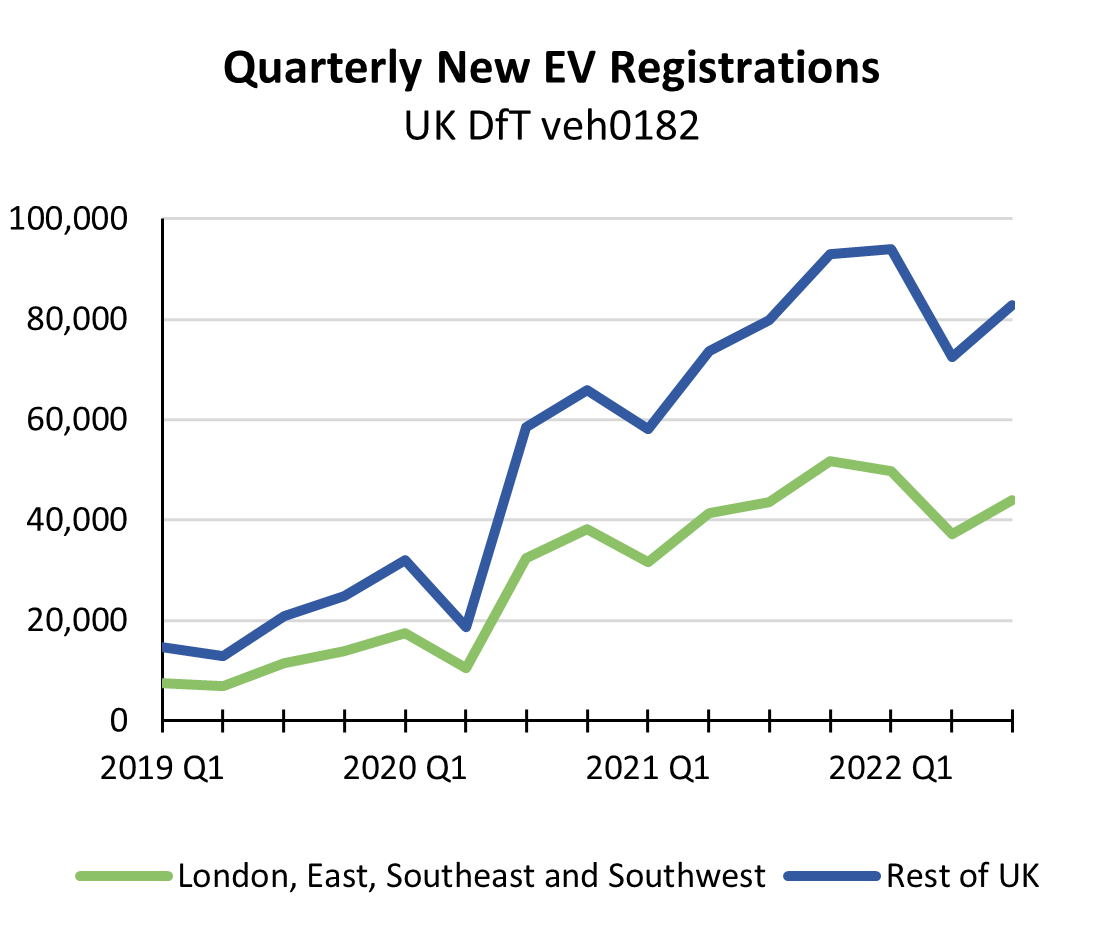

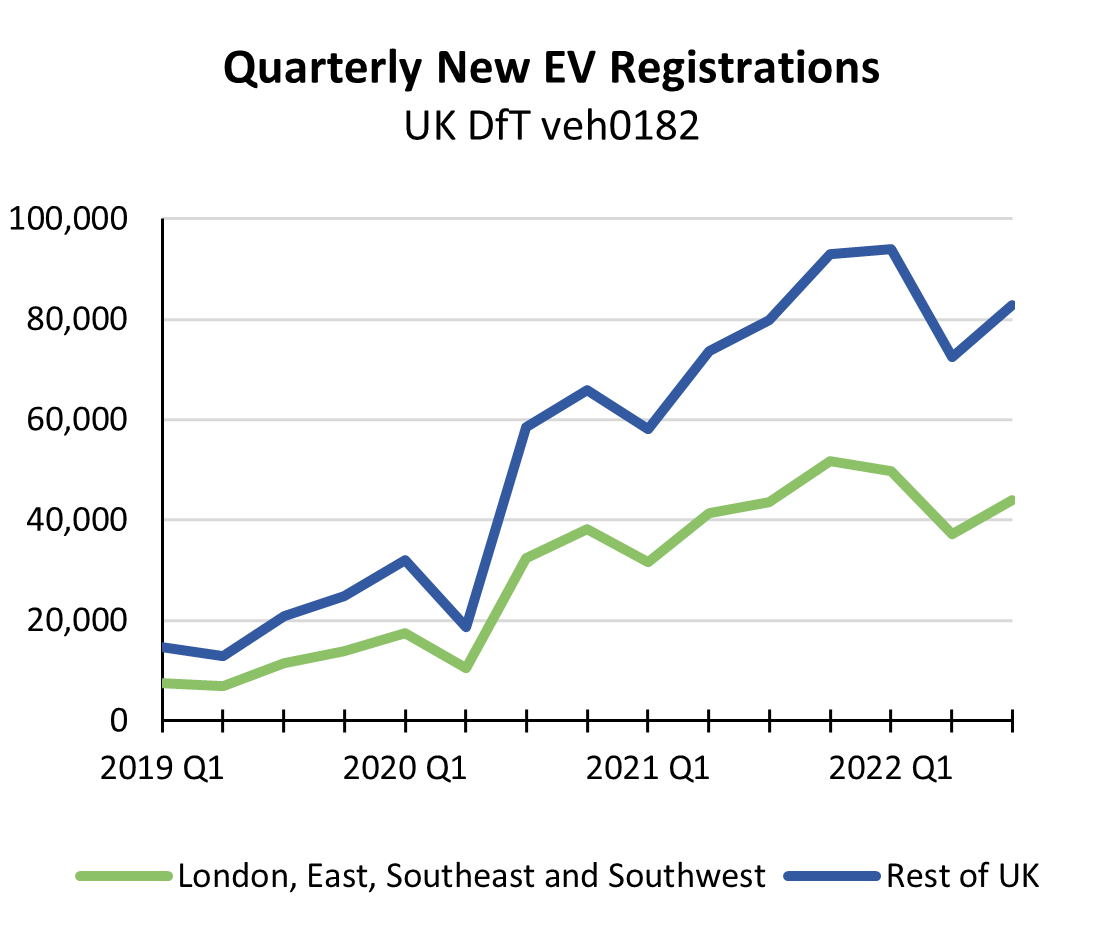

Immediately after the first COVID lockdown, adoption of new EVs here in the UK really started to take off.

Over the ensuing 3 years:

- New EV registrations in the South and East of England represented about ½ of the total and

- EVs now represent about 25% of new car sales.

Now, in the summer of 2023, we’re just getting into the 3rd anniversary of that initial wave of EV sales, and like the incoming tide, “off-lease” EVs will increasingly penetrate used car stocks.

How will the market cope?

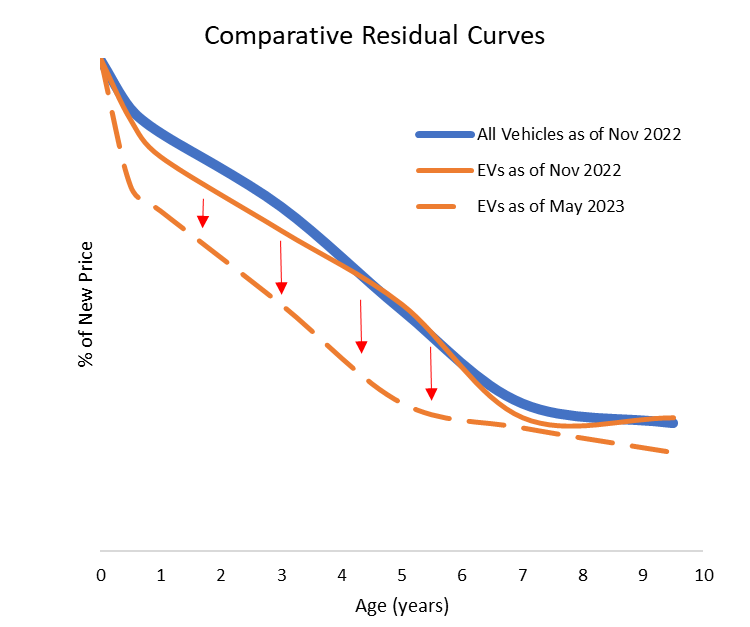

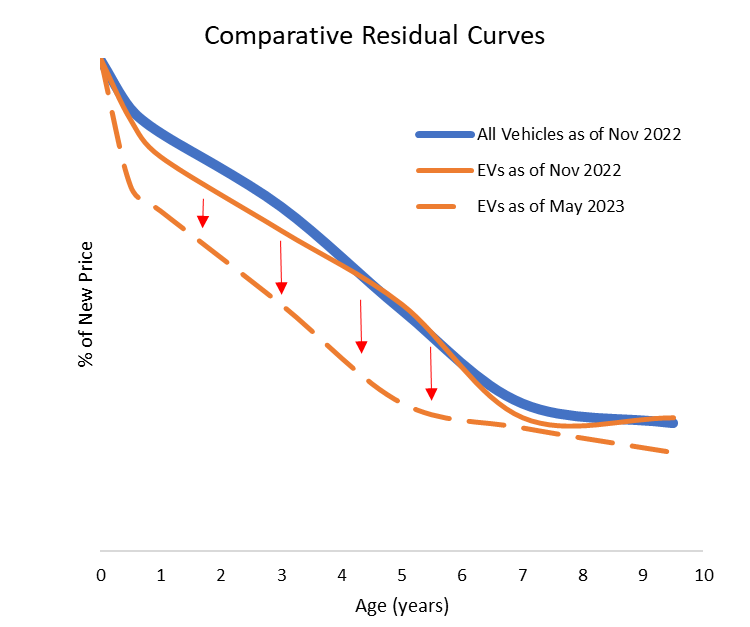

The increased supply of used EVs from that initial 2020 wave seems to have shocked the market. In November of last year, Cox’s EV residual curve (“eyeballed” below) looked to be right on top of that for the broader diesel and petrol-powered market. By May, only 6 months later, that same curve had taken a beating of 15% to 40%, depending on the vehicle age band.

So, what’s going on? Sure, we’ll malign used car dealers who haven't yet figured out how to “sell” electric vehicles. There's perhaps some misplaced scepticism around used EV battery performance. But remember, these aren’t pokey old G-Wiz that we’re selling. They’re premium Teslas, i-Paces and BMW i3s (I know, I know, there will be loads of Leafs, Ioniqs, Zoes, eCorsas and eNiros as well). This is solid EV technology that should maintain good “value” pricing.

The First Test of the Public Charging Network

Consumers once indicated that they wouldn’t adopt EVs until they could see a well-developed public charging infrastructure. However, the fact that EVs make up a far larger share of the UK's company-registered car parc indicates that tax-subsidized company car and salary sacrifice drivers have gleefully opted for sexy new “cost-adjusted” Teslas over the dowdy old petrol-powered BMW 3.

In practice, these arguably higher-income households with wider access to off-street parking have found that cheaper and more convenient domestic charging nearly eliminates their reliance on public infrastructure.

As EVs move through their first lease and into the used markets, the pool of EV drivers will expand to include many more of those without off-street charging, who will rely much more fully on the public charging infrastructure.

As a result, we may indeed be seeing the first real test of the UK’s public EV charging network.