The Department for Transport has been consulting on whether it should extend the appraisal period for transport schemes beyond the current 60 years. At the root of the question is the recognition that some transport interventions have a life longer than the appraisal period and can continue to give benefits long after the 60 years that are considered. How should this be captured when coming to a view on value for money? Over recent weeks Steer considered the question and its implications and submitted a response.

Our opinion is that the long-term costs and benefits of a transport investment should be considered when decision-makers come to a view on its value for money. However, we do not believe that extending the appraisal period beyond the current 60 years is the way to do this. We believe alternative approaches to extending the monetised appraisal period beyond 60 years would be strongly preferred.

We developed this view for a number of reasons, which we summarise here:

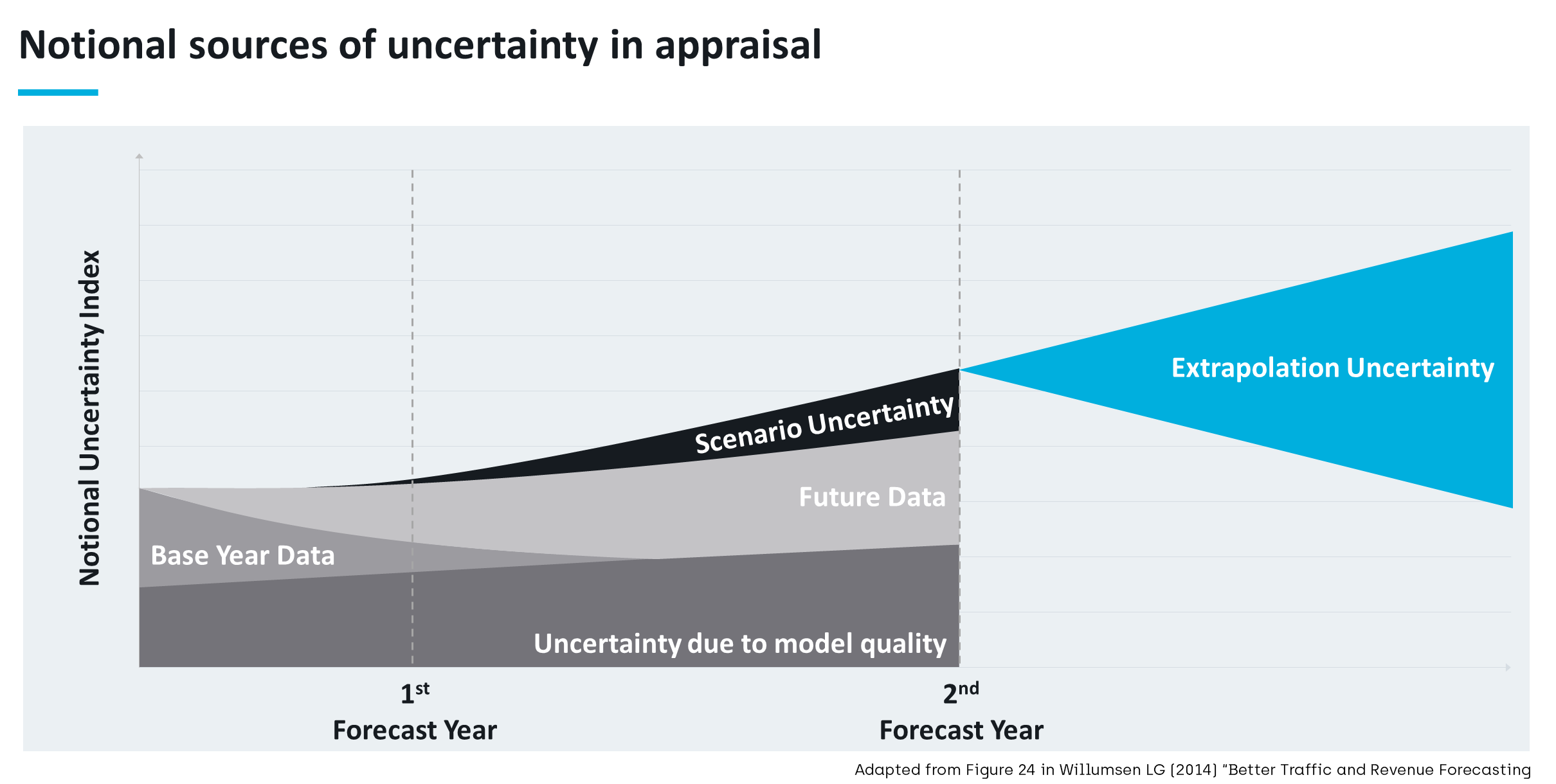

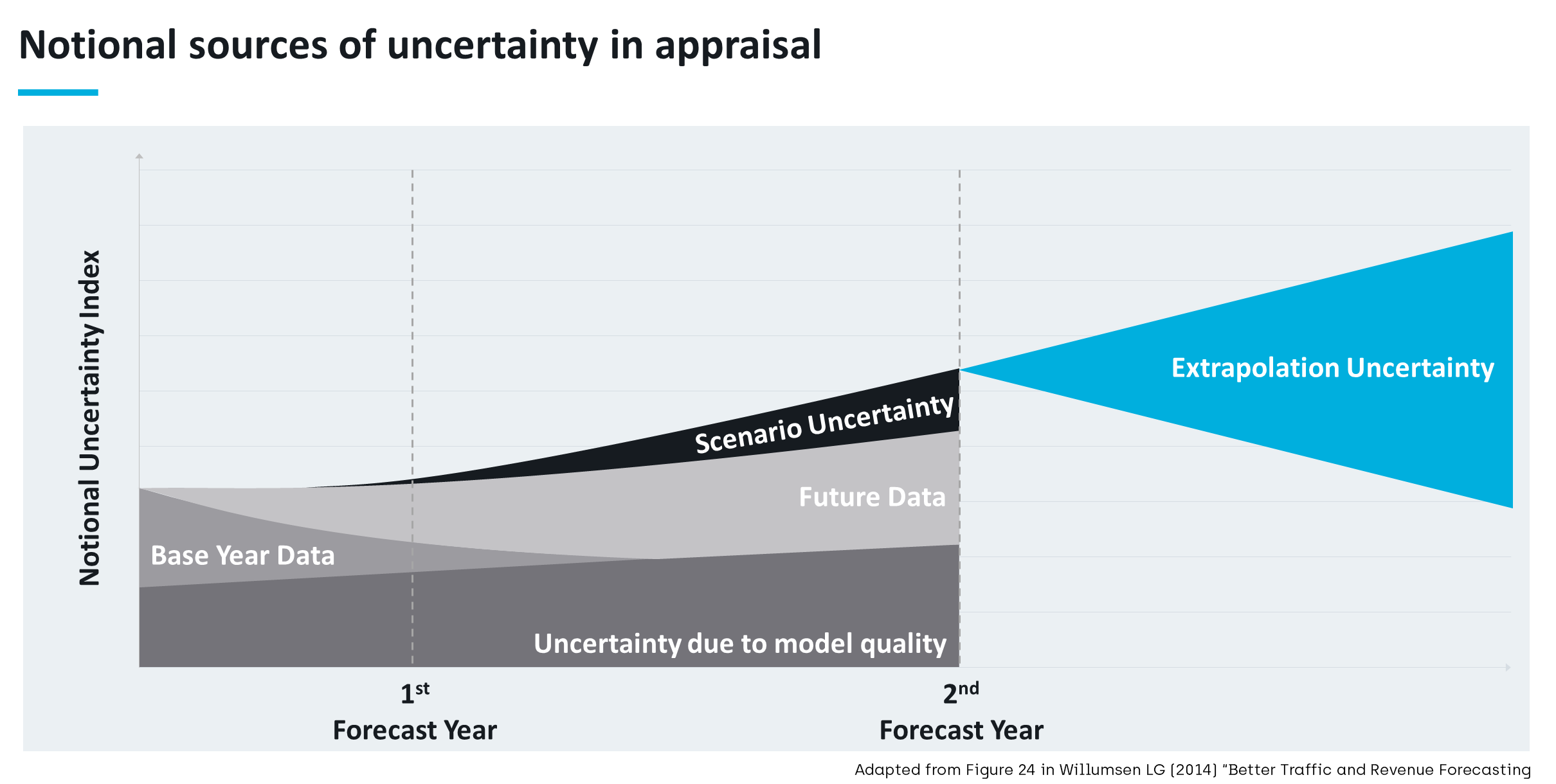

- Inherent forecasting uncertainty: Models can only look so far into the future before forecast uncertainty is so great that there can be little confidence in the numbers that are produced. The longer the look into the future, the more uncertain are the forecasts.

- Reliance on extrapolation: all appraisals rely on extrapolating from the last forecast year. The longer the appraisal period, the greater the proportion of the Present Value of Benefits (PVBs) which is simply an extrapolation from the last forecast year and the greater is the importance of assumptions on inputs to the appraisal including the growth of population, GDP and values of time. Such assumptions are themselves inherently uncertain and therefore the longer the appraisal period, the less certainty there is in the PVB, regardless of our confidence with our forecasting models.

- Compounding (multiplicative) effects: The assumptions used to extrapolate benefits interact and have multiplicative effects. The assumptions are applied to forecasts that are also uncertain. Errors compound over time.

- The profile and scale of costs: The longer the appraisal period the more important the assumptions made on on-going maintenance and renewal costs. However, there are considerable uncertainties around these which increase the longer we look into the future.

- Changing technology, operations and competition: Our appraisals assume that the infrastructure being appraised delivers the same outputs in the final appraisal year as it does in the final forecast year. They also assume that the competitive position is also largely unchanged. For example, a generalised minute’s advantage of rail over road has the same impact in the last forecast year and the final appraisal year. Both these positions are implausible, but with a 60-year appraisal have a limited impact on the assessed PVBs and Present Value of Costs (PVCs). Extending the appraisal period places greater weight on an implausible position.

- Value for money thresholds: In our view, the value for money thresholds that are used to assess whether schemes are poor, low, medium, high or very high value for money should be a function of the applied discount rates and appraisal periods. It is important to consider not just social returns on investment, but also how long it takes for those returns to occur. And the increased inherent uncertainty of costs and benefits when assessed over a longer appraisal period also suggest the need for higher Benefit Cost Ratio (BCR) thresholds. Extending appraisal periods should therefore also require a rebasing of the value for money thresholds. In general, with a longer appraisal period because of forecasting uncertainty and the greater impact of extrapolation from the last forecast year on the BCR, we find it difficult to see sufficient reasons to adjust the view on value for money of an intervention even if the BCR increases.

- Stakeholder perception and credibility: Longer appraisal periods will mean that greater proportions of PVBs are extrapolations beyond the last forecast year and more of the BCR is explained by the assumptions made to make the extrapolations. Our view is that appraising over a longer period will undermine confidence in appraisal, not increase it.

Our conclusion is that the appraisal period does not have to be extended to allow the long life of certain assets to be considered when coming to a view on value for money. We suggest that the Department focus its efforts on increasing confidence in the appraisal system that we have currently and work with decision-makers to help them interpret the Benefit Cost Ratios produced to allow a broad-based assessment of value for money. We have put forward a number of suggestions that may help with this.

The Department has said that it will publish its consideration of the consultation responses within three months. Read our full response.