Everyday millions of US residents take to the nation’s highways, but what will these journeys look like in the future? In our ‘Highway to the Future’ series our North American Infrastructure team will explore the innovations that could soon shape the way ordinary Americans drive. From flying cars to electrification, our team of dedicated experts will unpack how ideas once considered impossible could soon be a fact of day-to-day life.

Forecasting the impact of Connected Autonomous Vehicles (CAVs) on long term traffic growth and travel behavior has been an area of uncertainty for many years. However, the way in which we, as forecasters, have been addressing this uncertainty has been changing as the CAV market has been evolving:

- ~10 years ago, we typically provided qualitative responses to investors or Rating Agencies about the impact of CAVs on our forecasts, highlighting the key aspects to consider but concluding that there was too much uncertainty to quantify the impact.

- ~5 years ago, we tended to include qualitative commentary in our reports on the potential impact of CAVs for longer term concessions.

- More recently, for some studies, we are including estimated quantitative impacts of CAVs, typically as part of a sensitivity tests or alternative scenarios to the base case with clear assumptions on technology and CAVs.

This trend is not only supported by the evolving automobile market but also by the fact that in some cases our clients are considering investing in road technology to enable vehicles to operate autonomously within the facility ahead of this being available in the wider network.

To keep up with this trend, and ensure our forecasts capture the current risks and opportunities, there are some key factors to consider when including the impact of CAVs in our forecasts.

Understanding levels of autonomy

First, a clear understanding of the definitions and levels of autonomy. The Society of Automotive Engineers (SAE) defines 6 levels of autonomy which take us gradually from non-autonomous to fully autonomous vehicles, where L4 and L5 are generally viewed as ‘fully autonomous’:

- L0 - No driving automation: Driver responsible for all aspects of driving.

- L1 - Driver assistance: Driver 100% attentive and involved, vehicle able to do limited single tasks autonomously when requested (e.g. Adaptive Cruise Control).

- L2 - Partial driving automation: Driver 100% attentive and involved, vehicle able to do multiple tasks autonomously when requested (e.g. Cruise Control and Lane Centering).

- L3 - Conditional driving automation: Driver in position, ready to take control if requested (e.g congestion chauffeur).

- L4 - High driving automation: Limited/no input needed when driving on specific corridors.

- L5 - Full driving automation: Limited/no input needed when driving across the highway network.

The industry has adopted these definitions, and they are now common language when considering the transition to CAVs.

Forecasting CAV penetration levels

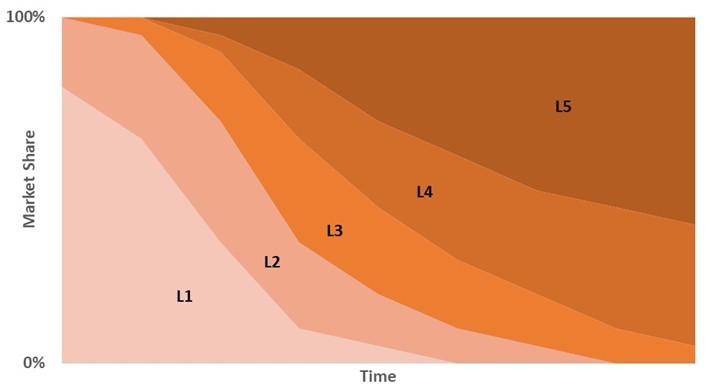

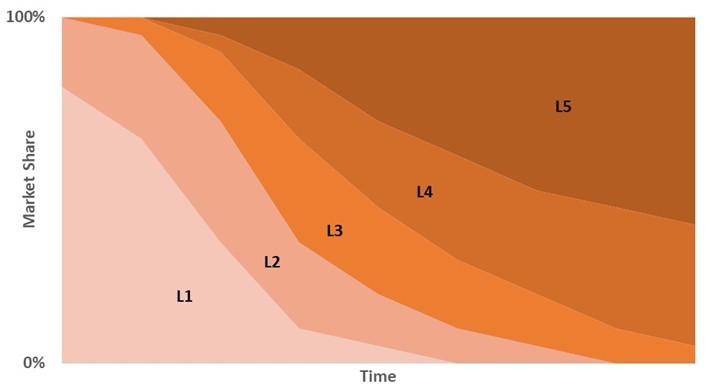

Second, assumptions about how the CAV penetration will evolve in time. Below is an illustration of how the transition may occur through time.

The speed of transition through these levels will depend on: (i) supply-demand market dynamics, (ii) technology advancements and (iii) evolution of the regulatory framework.

Many industry bodies have produced forecast outlooks which have since been revised, indicating that the arrival of a fully autonomous network appears more distant than previously expected. Our observations from a recent literature review are:

- By 2030 most scenarios consider 0% or very low L4/L5 CAV penetration. Suggesting fully autonomous driving is not likely in the near term.

- By 2050 forecasters expect L4/L5 vehicles to account for between 30% and 50% of the vehicle fleet. Therefore, the point at which full autonomous vehicles will make up most of the fleet is not likely until after 2050 (25 years out at least).

Impact of CAVs on highways

The third factor to consider is a set of assumptions on how the travel conditions and behavior will be impacted at different points in the CAV transition. Some of points we typically consider are:

- Capacity: At high CAV penetration rates highway capacities will increase, due to reduced headways; smoother driving; and platooning. These capacity gains are likely to be higher on freeways than on suburban/local roads. During the transition safety restrictions may be introduced that increase headways and reduce capacities.

- Demand: CAVs could lengthen or induce additional trips, due to a combination of: Improvements in journey times and comfort; wider diversity of pricing and ownership models; empty vehicle running as CAVs repositioning themselves; and increased uptake by demographics that are currently not able to drive.

- Value of Time (VOT): VOTs may be lower because people are able to be more productive in their travel time, and therefore there is less urgency for them to get to their destination.

Additionally, we also may make assumptions in the shorter term to capture the impact of infrastructure investment in tolled facilities, which enables autonomous driving when this is not possible on the wider network. We typically refer to this benefit as Value of Autonomy or Technology and apply it as an effective discount (in either time of money) for those using the toll facility.

What does all this mean for tolled facilities?

The impact of CAVs will vary depending on the timeframe considered, the expected level of CAV penetration within this timeframe and the cumulative effects of CAVs on both highway use and behavior.

In the short term lower levels of autonomy could be a benefit for tolled facilities who may be able to offer infrastructure that enables and accelerates higher levels of autonomous driving than on the wider highway network. This could give the opportunity to charge additional fees and/or will attract more users to the facilities.

In the medium term when the highway network is a mix of autonomous and non-autonomous vehicles, there will continue to be an upside for tolled infrastructure, as with investment in infrastructure they will have a greater control of the environment and will be able to offer better travel conditions than on the wider network.

In the long term when the majority of the fleet is fully autonomous, we expect increases in both capacity on the network (which could have a negative impact on tolled facility revenues) and increases in demand (which could have a positive impact on revenues) the net impact of these two key factors will depend on the characteristics of the facility.

Going forward, the largest uncertainty is around exactly how long and what period these phases will cover. As the CAV market evolves, we will continue to enhance our understanding and refine how we represent the impact of CAVs in our forecasts.