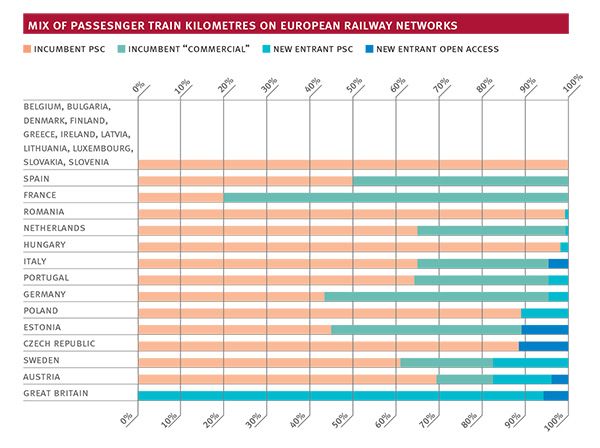

Franchising has been a reality in Great Britain’s railways for over 15 years. However, with some exceptions, competitive tendering of rail services has yet to take off in many European Member States, as the figure below shows.

The current situation reflects existing legislation on public service obligations, in particular Regulation (EC) 1370/2007, which requires that Member States competitively tender road-based services but does not impose this requirement for rail. The proposals put forward in January 2013 by the European Commission in the Fourth Railway Package seek to extend compulsory competitive tendering of public service contracts to rail and, if adopted in their current form, would require Member states to tender rail service contracts from December 2019 (with the exception of those below a minimum threshold). Directly awarded contracts put in place before that date would need to end by the end of December 2022.

From entry into force of the final Fourth Railway Package provisions, we estimate that at least 20 tenders will be let across Europe each year, and current and potential future operators will need to consider the implications for their resources and internal organisation. Those operators that currently have experience in bidding for and winning franchise and concession contracts will clearly have an advantage over new entrants and can be expected to capitalise on this. At the same time, competition from established national operators will be strong, and significant barriers to entry are likely to remain for some time.

As part of the impact assessment of the Fourth Railway Package undertaken for the European Commission, Steer Davies Gleave carried out a detailed investigation of rail markets across the EU. This work, and our continuing support to a number of operators bidding for tenders in different Member States, demonstrates the need for all bidders to be familiar with local market conditions, regulatory arrangements and approaches to procurement in order to maximise the chances of success. Thorough preparation in anticipation of bidding opportunities, including market analysis, the development of competitive strategies and the identification of potential rolling stock, are critical in responding effectively to the new competitive environment in European rail.